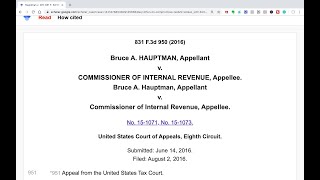

< iframe size=" 480" elevation=" 320" src =" https://www.youtube.com/embed/DN8Z09_uP_Q?rel=0" frameborder=" 0" allowfullscreen >< img style=" float: left; margin:0 5px 5px 0; "src=" http://taxdr.org/wp-content/uploads/2021/05/8cOtsD.jpg"/ > Haumptman v Commisioner of Internal Income-- 831 F. 3d 950 (8th Cir. 2016) is an intriguing case entailing a deal in compromise on back tax obligations owed to the IRS.

Below is the link on Google Scholar so you can read it for yourself-- https://scholar.google.com/scholar_case?case=14218788548091356663&q=offer+in+compromise+tax&hl=en&as_sdt=40006&as_ylo=2015

This case will certainly go over the territory (power) of the tax court to listen to the appeal as well as possibly what NOT to do when trying to get the Internal Revenue Service to approve an offer in concession.

The offer in compromise was a question as to collectibility offer in concession-- swelling sum paid over 4 months-- for $500,000 on over $15,000,000 in IRS debt.

Not to spoil it yet the Internal Revenue Service declined this offer.

Hope you take pleasure in and also many thanks for watching!

John

John G. Watts

Watts & Herring, LLC

Standing for consumers across Alabama

205-879-2447

< iframe size=" 480" elevation=" 320" src =" https://www.youtube.com/embed/DN8Z09_uP_Q?rel=0" frameborder=" 0" allowfullscreen >< img style=" float: left; margin:0 5px 5px 0; "src=" http://taxdr.org/wp-content/uploads/2021/05/8cOtsD.jpg"/ > Haumptman v Commisioner of Internal Income-- 831 F. 3d 950 (8th Cir. 2016) is an intriguing case entailing a deal in compromise on back tax obligations owed to the IRS.

Below is the link on Google Scholar so you can read it for yourself-- https://scholar.google.com/scholar_case?case=14218788548091356663&q=offer+in+compromise+tax&hl=en&as_sdt=40006&as_ylo=2015

This case will certainly go over the territory (power) of the tax court to listen to the appeal as well as possibly what NOT to do when trying to get the Internal Revenue Service to approve an offer in concession.

The offer in compromise was a question as to collectibility offer in concession-- swelling sum paid over 4 months-- for $500,000 on over $15,000,000 in IRS debt.

Not to spoil it yet the Internal Revenue Service declined this offer.

Hope you take pleasure in and also many thanks for watching!

John

John G. Watts

Watts & Herring, LLC

Standing for consumers across Alabama

205-879-2447

Home"No depiction is made that the top quality of the legal solutions to be executed is greater than the high quality of legal solutions executed by other attorneys."