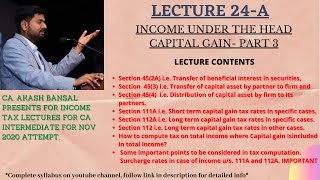

< iframe size= "480" height= "320" src= "https://www.youtube.com/embed/ItwUcjm3kP0?rel=0" frameborder= "0" allowfullscreen >< img style= "float: left; margin:0 5px 5px 0;" src= "http://taxdr.org/wp-content/uploads/2021/09/FNzdX7.jpg"/ > Earnings Tax Obligation Law by CA. Akash Bansal (All Level Ranking holder).

Video Content-.

1. Modification of last lecture with regard to area 45( 1A), 45( 2 ), 45( 5) as well as 45( 5A).

2. Section 45( 2A) i.e. Transfer of useful interest in securities, Section 45( 3) i.e. Transfer of capital possession by companion to firm as well as Area 45( 4) i.e. Distribution of funding property by firm to its companions.

3. Section 111A i.e. Short-term resources gain tax obligation rates in details cases.

4. Area 112A i.e. Lengthy term capital gain tax obligation rates in certain situations.

5. Section 112 i.e. Lengthy term capital gain tax obligation rates in other cases.

6. Exactly how to compute tax on overall income where Resources gain is consisted of in overall revenue?

7. Some important indicate be thought about in tax obligation computation.

8. Surcharge prices in situation of revenue u/s. 111A as well as 112A. IMPORTANT.

Download and install notes: https://drive.google.com/file/d/1RCIMWlUnuyRm2j3tiCn0hZPyzpTw_o7g/view?usp=sharing.

Alteration Lectures and Phase Notes:.

https://www.youtube.com/playlist?list=PLQEXKMdznfSuFfbBYJlWRXMbYpjhpSlwZ.

INTRO video clip:.

https://youtu.be/VOT01-OCiSc.

Telegram: https://t.me/caakashbansal.

Linkedin: https://www.linkedin.com/in/akash-kumar-bansal-b2714b139.

G-Mail: [email protected].

Instagram: https://www.instagram.com/dt_cainter

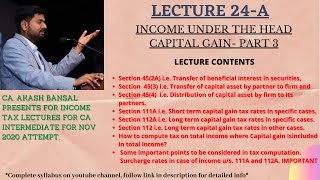

< iframe size= "480" height= "320" src= "https://www.youtube.com/embed/ItwUcjm3kP0?rel=0" frameborder= "0" allowfullscreen >< img style= "float: left; margin:0 5px 5px 0;" src= "http://taxdr.org/wp-content/uploads/2021/09/FNzdX7.jpg"/ > Earnings Tax Obligation Law by CA. Akash Bansal (All Level Ranking holder).

Video Content-.

1. Modification of last lecture with regard to area 45( 1A), 45( 2 ), 45( 5) as well as 45( 5A).

2. Section 45( 2A) i.e. Transfer of useful interest in securities, Section 45( 3) i.e. Transfer of capital possession by companion to firm as well as Area 45( 4) i.e. Distribution of funding property by firm to its companions.

3. Section 111A i.e. Short-term resources gain tax obligation rates in details cases.

4. Area 112A i.e. Lengthy term capital gain tax obligation rates in certain situations.

5. Section 112 i.e. Lengthy term capital gain tax obligation rates in other cases.

6. Exactly how to compute tax on overall income where Resources gain is consisted of in overall revenue?

7. Some important indicate be thought about in tax obligation computation.

8. Surcharge prices in situation of revenue u/s. 111A as well as 112A. IMPORTANT.

Download and install notes: https://drive.google.com/file/d/1RCIMWlUnuyRm2j3tiCn0hZPyzpTw_o7g/view?usp=sharing.

Alteration Lectures and Phase Notes:.

https://www.youtube.com/playlist?list=PLQEXKMdznfSuFfbBYJlWRXMbYpjhpSlwZ.

INTRO video clip:.

https://youtu.be/VOT01-OCiSc.

Telegram: https://t.me/caakashbansal.

Linkedin: https://www.linkedin.com/in/akash-kumar-bansal-b2714b139.

G-Mail: [email protected].

Instagram: https://www.instagram.com/dt_cainter

Lecture 24A | Income Tax Law | CA Intermediate | Capital Gain (Part 3A)

Lecture 24A|Earnings Tax Regulation|CA Intermediate|Funding Gain (Part 3A)

Category :

Form 433-A