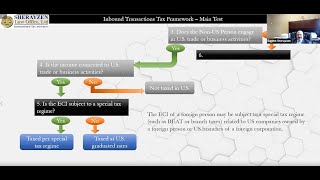

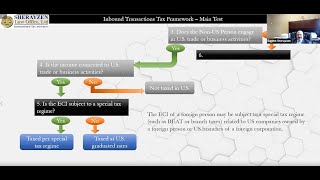

Mr. Sherayzen, a worldwide tax obligation legal representative and also owner of Sherayzen Law Workplace, Ltd., reviews the tax meaning of "Efficiently Connected Earnings" or ECI. This episode belongs to a CLE arranged by the Minnesota State Bar Organization International Business Legislation Section on January 28, 2021.

Sherayzen Legislation Workplace, Ltd. concentrates on worldwide tax planning, overseas voluntary disclosures (Structured Domestic Offshore Procedures, Streamlined Foreign Offshore Procedures, Volunteer Disclosure Method, etc.) and also worldwide tax obligation conformity (FBAR, FATCA, Kind 8938, international business ownership, foreign trust funds, et cetera).

To learn more regarding Sherayzen law Office see http://sherayzenlaw.com

Mr. Sherayzen, a worldwide tax obligation legal representative and also owner of Sherayzen Law Workplace, Ltd., reviews the tax meaning of "Efficiently Connected Earnings" or ECI. This episode belongs to a CLE arranged by the Minnesota State Bar Organization International Business Legislation Section on January 28, 2021.

Sherayzen Legislation Workplace, Ltd. concentrates on worldwide tax planning, overseas voluntary disclosures (Structured Domestic Offshore Procedures, Streamlined Foreign Offshore Procedures, Volunteer Disclosure Method, etc.) and also worldwide tax obligation conformity (FBAR, FATCA, Kind 8938, international business ownership, foreign trust funds, et cetera).

To learn more regarding Sherayzen law Office see http://sherayzenlaw.com

Effectively Connected Income: Introduction | US International Tax Lawyer & Attorney

Properly Connected Income: Introduction|US International Tax Obligation Attorney & & Lawyer

Category :

Form 433-A